There are over 1,600 innovative companies in the lifescience sector born between 2019 and 2024, representing 11.4% of the entire Italian innovation ecosystem and have raised €303.3 million in investments in 2024, of which €122.5 million in the second half of the year. With these numbers, the sector presents itself as a relevant field in the Italian innovation panorama, a fact that is confirmed by the third edition of Listup, the research Observatory realised by Indicon dedicated to the Italian ecosystem of innovative companies, start-ups and SMEs, operating in the life sciences sector. The Observatory – realised in collaboration with Growth Capital, Italian Tech Alliance and Innovup, has the patronage of Assolombarda and IAB – Italian angels for biotech, and the contribution of Confindustria medical devices and Fondazione Enea tech and biomedical.

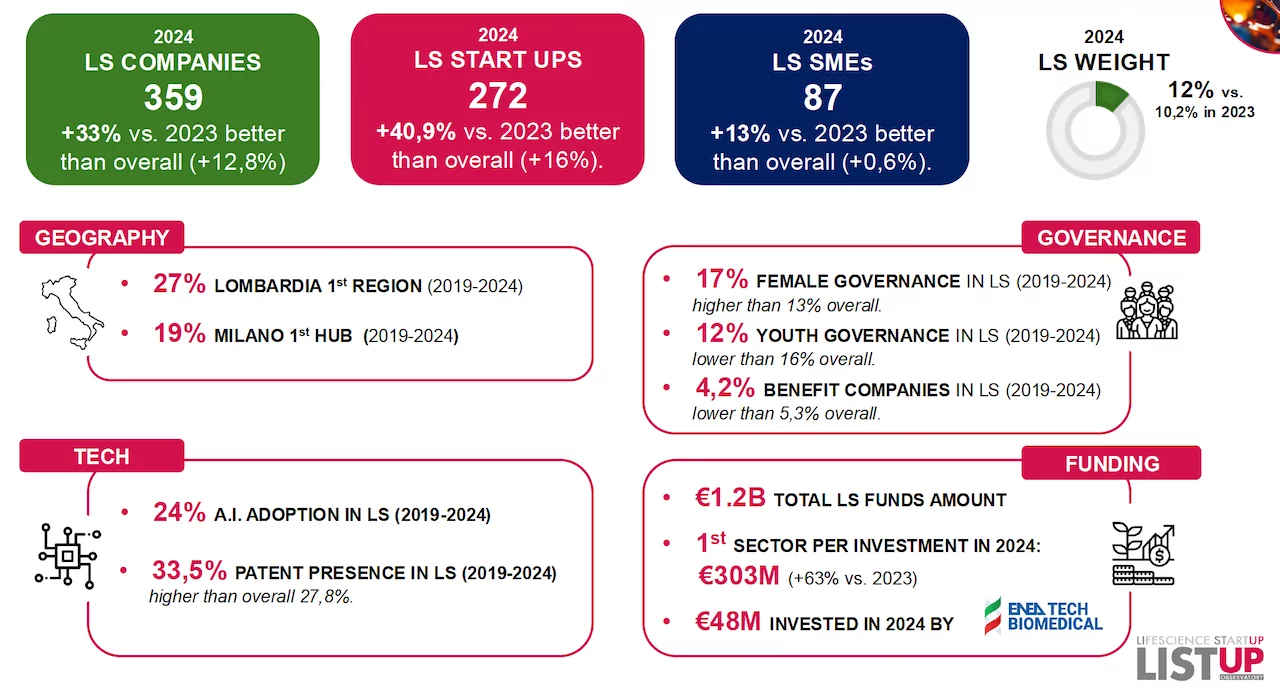

The data emerging from the observatory relating to the second half of 2024, presented by Paola Lanati, CEO Indicon and vice-president of IAB (in the photo), show how the Italian startup and SME ecosystem is experiencing a period of strong growth, with companies operating in the lifescience sector continuing to be among the main drivers of innovation. With a total of 1,603 registered companies, the sector accounts for 11.4% of innovative companies in Italy, up from 11.2% recorded in the previous edition of Listup, in September 2024.

In the period between 2019 and 2024, the number of lifescience start-ups increased compared to 2023, reaching 1,232 active companies, or 10.7% of the total number of Italian start-ups. The most numerous are those operating in the field of digital health, representing 40% of start-ups in the sector. In the second half of 2024, lifescience startups also showed a remarkable growth rate, with 134 new realities registered, for an increase of 83.6% compared to the same period last year. This figure is higher than the average growth of Italian innovative start-ups, which stands at 22.2 per cent.

Lombardy continues to be the leading region for the growth of lifescience start-ups, amounting to 106% compared to the second half of 2023, with Milan confirming its position as the main hub, with 18% of start-ups registered in the period 2019-2024.

Lifescience startups continue to focus on areas of high innovation, with a focus on digital health and artificial intelligence. In H2 2024, AI adoption increased by 107% compared to H2 2023, with 26.5% of startups integrating artificial intelligence into their business. Furthermore, the use of telemedicine is up 50%, with 33 startups focused on this technology in 2024, up from 22 in 2023.

The sector is seeing an increase in investments, supported by the emergence of new funds, totalling more than €1.2bn in 2024, and is confirmed as the top investment attraction in Italy, with €303.3m raised in 2024, and an increase of 63% compared to 2023. Biotech and pharma startups continue to represent the most funded segment, with a total of €78.2m raised in 14 rounds in the second half of 2024. The Enea tech and biomedical foundation has played a key role in supporting innovative start-ups and SMEs, investing over EUR 60 million in 13 lifescience companies between the end of 2024 and the beginning of 2025, with a focus on the biotech (EUR 29 million), med tech (EUR 17.75 million) and digital health (EUR 15 million) areas.

A significant fact to emerge from the report concerns the growing presence of women in the lifescience startup scene. Those founded by women represent 19% of the total, which is higher than the general average for Italian start-ups, which stands at 14%. This positive trend is also confirmed for lifescience SMEs, where the female prevalence reaches 11%, compared to 8% of the overall average.

Lifescience SMEs, comprising 371 companies registered between 2019 and 2024, are experiencing a period of solid growth, accounting for 14.9% of the total number of innovative Italian SMEs. Med tech SMEs dominate the landscape, accounting for 36% of the total. Lombardy also remains the most active region in this segment, with Milan hosting 23% of registered SMEs.

In H2 2024, lifescience SMEs that invested in research and development show a 74% growth rate compared to H1 2024, with a strong focus on patent and software registration. Adoption of artificial intelligence in SMEs increased by 40% in H2 2024 compared to H1 2024, reaching 16% of total SMEs.

Lanati says in a note: ‘Innovative lifescience companies in Italy are showing great attractiveness; our sector needs much more investment than others, but also guarantees interesting profitability. High-level Italian research needs to be supported with adequate funding but also with business skills; this is why it is important to continue to grow the ecosystem, to create synergy between all players, and to succeed in attracting foreign investment. The Listup report was created with these objectives in mind, to help measure innovation trends and photograph trends, players and opportunities. Lifescience is one of the strategic sectors for the country, there are several institutional initiatives that demonstrate this, we need speed in making funds available and building strong business teams to support researchers in creating companies’.

“This edition of the observatory once again confirms that lifescience is one of the most dynamic sectors in the Italian innovation ecosystem, both in terms of investment attraction and entrepreneurial capacity, with start-ups in the sector accounting for 10% of those active in our country,” comments Francesco Cerruti, general manager of Italian tech alliance – This is why it is essential to support the consolidation trend in Italian lifescience, in particular by adopting some regulations, such as the reshaping of the research and development tax credit, to meet the needs of operators and by working to increasingly increase the involvement of corporations, which have increased slightly compared to the recent past but are still too cold towards this field’.

“The lifescience sector continues to grow, confirming itself as one of the main drivers of innovation in Italy. The increase in start-ups and the ability to attract investment demonstrate the sector’s potential to generate economic and social impact. However, in order to sustain this growth, targeted interventions are needed: streamlining bureaucracy, clarifying the rules contained in the so-called Scaleup Act by reducing current interpretative uncertainties, incentivising collaboration between large companies and startups, and aligning our country with EU standards. As Innovup and Assolombarda, we support all the players in the innovation chain, facilitating access to resources, skills and networking, so that the ecosystem can grow and compete internationally,’ adds Giorgio Ciron, director of Innovup.

“Lifescience is confirmed as a key sector for venture capital, with the highest amount invested in 2024 and consistent deal flow over the years. The well-established presence of VC funds in the sector for years has fostered the growth of late-stage start-ups, leading to increasingly large rounds. However, the number of exits remains limited. For 2025, we expect stability in investments, consolidation of the most promising startups and natural selection based on pipeline strength, while the issue of exits will remain an open challenge,’ he emphasises Fabio Mondini de Focatiis, founding partner di Growth Capital.

The presentation of the report was also attended by Fabrizio Cannioto, senior research analyst Centro studi Confindustria dispositivi medici; Fabrizio Chines, member of the Farmindustria board; Chiara Cormanni, vice president of Assolombarda Young Entrepreneurs Group; Federica Draghi, founder and managing partner XGEN Venture; Giulio Pompilio, chief scientific officer Perfetto; Maria Cristina Porta, general director of the Enea tech and biomedical foundation; Giancarlo Testaverde, vice president of ggobal operation MMI; Paola Vella, councillor of the Lombardy life sciences cluster; and Gianmario Verona, chairman of the supervisory board of the Human Technopole Foundation.

ALL RIGHTS RESERVED ©