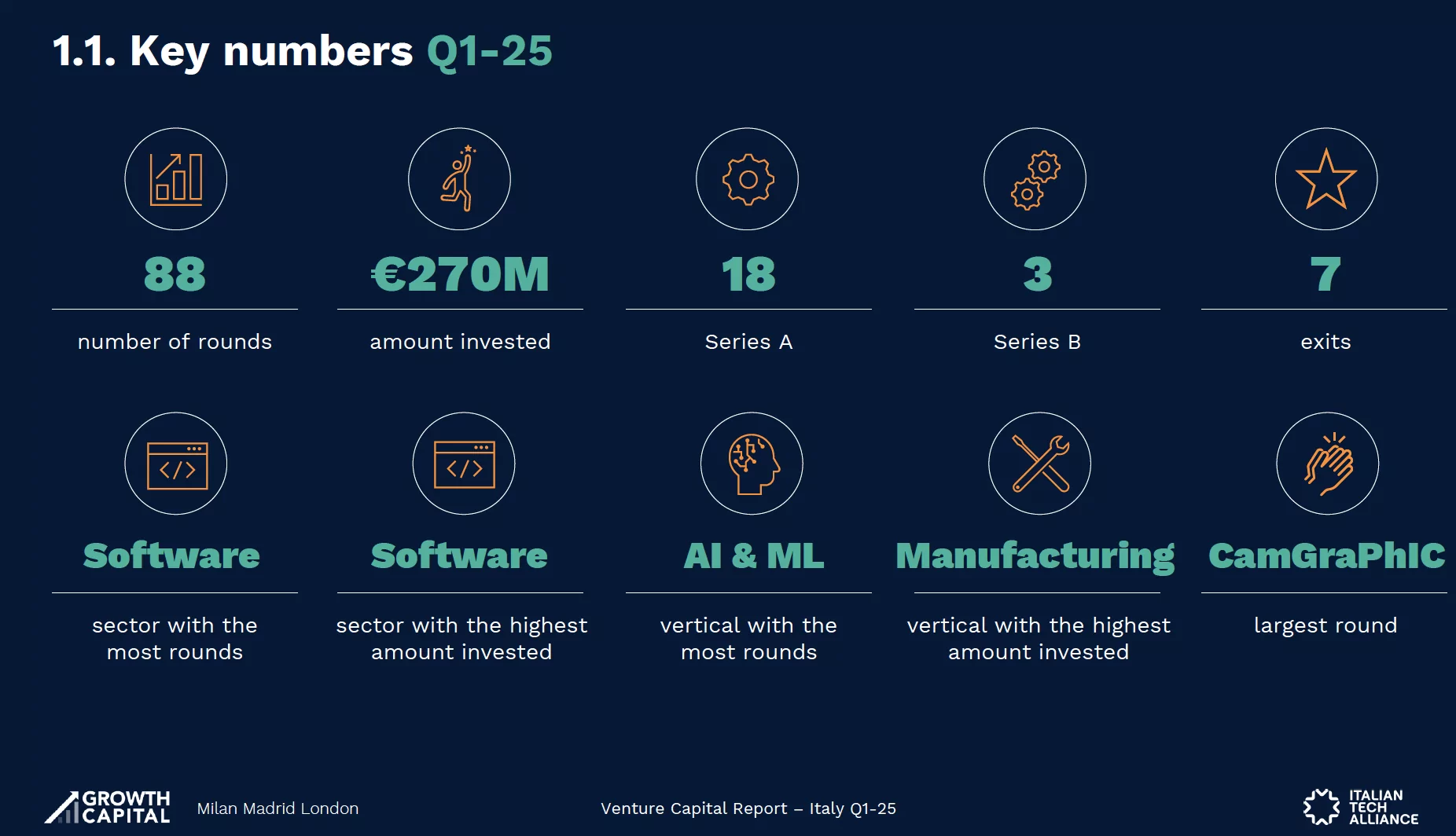

In the first quarter of 2025, EUR 270 million were invested in start-ups in Italy, compared to EUR 355 million in the fourth quarter of 2024, in 88 investment rounds. Q1-25 recorded the highest number of Series A rounds since Q4-22. Series A rounds also catalysed 49% of the amount invested during the quarter. The number of exits rose from 4 (Q4 2024) to 7. Software is the sector with both the highest collection and the highest number of rounds. After the EUR 1.4 billion raised by the 15 new funds announced in 2024, 3 more funds were launched during Q1-25, with a total raising to date of EUR 145 million.

This is the scenario outlined by the Observatory on Venture Capital in Italy conducted by Growth Capital in collaboration with Italian Tech Alliance.

With EUR 17 billion invested in 2,433 rounds, Q1-25 in Europe shows stability in terms of transactions and a good start in terms of amount invested. This trend is broadly in line with the last four quarters, both in terms of number of rounds and amount. Looking ahead, at a European level, the key sectors that will catalyse investors’ attention the most will include AI agents, especially with specific application verticals, and defence technologies, driven mainly by the global geopolitical tensions of recent months.

Looking at Italy, with EUR 270m raised in 88 rounds, Q1 2025 is in line with the average of the last two years, both in terms of rounds and amount invested, excluding mega rounds (EUR 261m). Although only one round exceeded EUR 15m and none exceeded EUR 25m, EUR 270m was still raised, in line with the average for the quarters of 2024 (EUR 279m). In Q1 2025, 71 rounds were publicly announced (the highest number since Q4 2023). Including unannounced confidential rounds, the total rises to 88, in line with the average of the last two years.

Looking at the segmentation of rounds by type, Q1 2025 saw the highest number of Series A rounds since Q4 2022. With EUR 133m raised, series A rounds also catalysed 49% of the amount invested throughout the quarter. This is followed by seed rounds (EUR 80 million in 37 rounds), series B (EUR 25 million in 3 rounds), pre-seed (EUR 19 million in 23 rounds) and bridge rounds, with EUR 13 million invested in 7 rounds. The growth in the number of Series A rounds shows that the pipeline built over the past three years is starting to pay off, describing a trend that is expected to continue in the Italian landscape.

The first quarter of 2025 saw a surge in software sector rounds (20 in total), helped by the recent growth in investments in AI and machine learning. Next come lifescience and fintech with 10 rounds and smart city and deeptech with 9. In terms of amount invested, the situation is similar but with a slightly more balanced distribution, considering that the software sector rounds (particularly on AI) are mostly small and early stage. In first place we find software with 69 million euros raised, followed by lifescience (54 million), deeptech (43 million), fintech (32 million) and smart city with 24.

Regarding the top 5 deals in Q1-2025, Camgraphic (25m, series A) and Tethis (15m, series A) led the way, followed by Subbyx (15m, seed), Tensive (14m, series A) and Newronika (13.6m, series B). There were 7 exits, up from 4 in Q4 2024.

“In Italy, the first quarter of 2025 confirmed the solidity of the VC ecosystem, with €270m invested entirely in rounds of less than €25m and steady growth in the early-stage segment, bucking the European trend. The good results of the Series A rounds bear witness to how the work built up over the last three years is generating returns in terms of growth and solidity of the system,” commented Fabio Mondini de Focatiis, founding partner of Growth Capital, in a note.

“From an analysis of the numbers of this first quarter, some signs emerge that testify to the vitality of the ecosystem, but overall there is also a significant and worrying drop in investments, which contrasts with the need to foster the development of a sector that is fundamental for Italy’s economic growth, where it is necessary to reduce the gap with other European countries,’ explains Davide Turco, president of Italian Tech Alliance. The recently introduced incentive for social security institutions to allocate part of their investments to VCs could help to resume the growth trend, but for this to happen it is essential that the interpretative doubts that are preventing its concrete application be clarified as soon as possible. As the Italian Tech Alliance, we are working on the regulatory front at both national and EU level. The urgency of these stimulus measures is exacerbated by the uncertainty of the financial markets, which makes both fundraising and the exit of start-ups and scale-ups more difficult’.

The full report and research methodology are available at this link.

ALL RIGHTS RESERVED ©