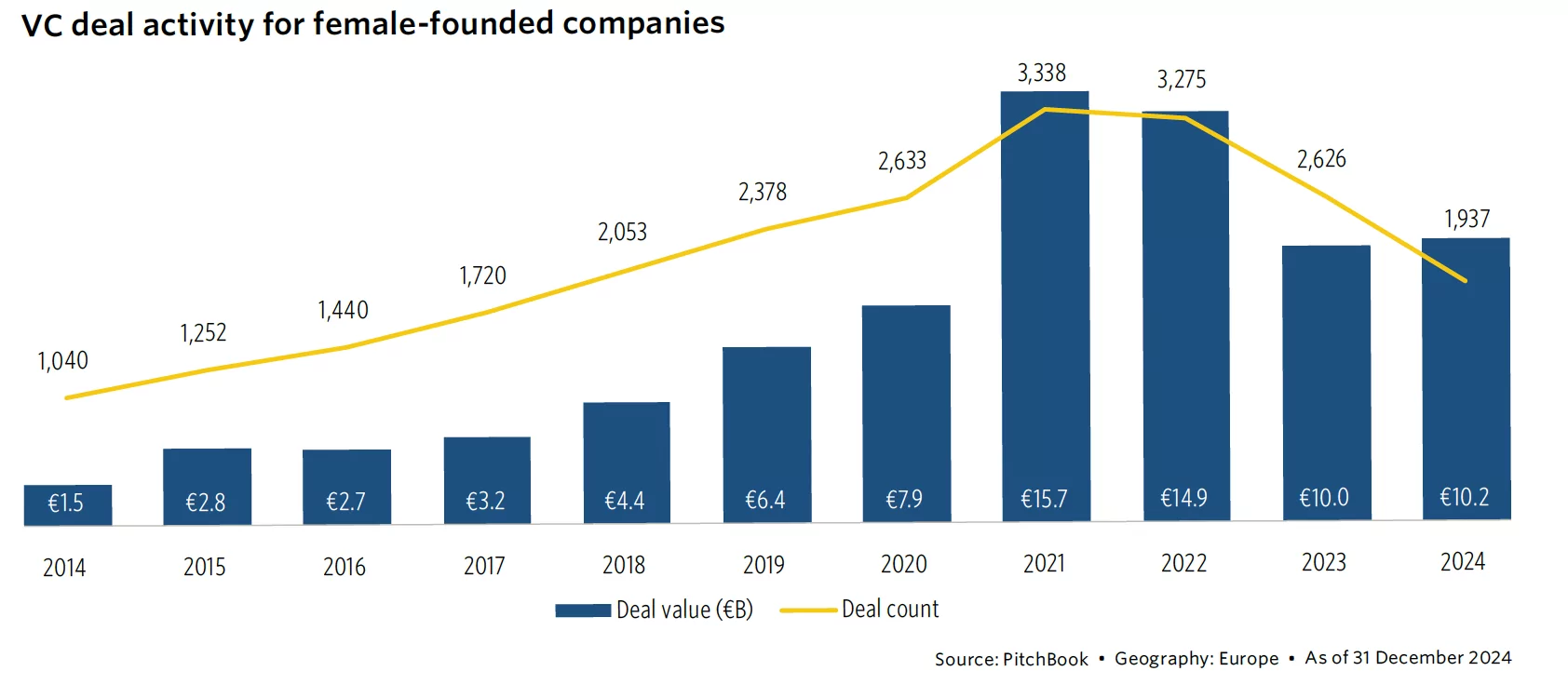

Pitchbook publishes report analysing investment trends in Europe in 2024 in start-ups with female founders. The analysis reveals that last year female founders in the European ecosystem raised more than €10 billion, marking the fourth consecutive year that this milestone has been reached.

While total invested capital remained strong, the number of transactions decreased by 26%, indicating a shift towards fewer but larger transactions.

Female founders faced valuation difficulties in the early stage, but gained momentum in the later stages. In the early stage, founders faced difficulties due to the higher risk tolerance of investors, with a 45% decrease in the number of transactions and a more dramatic drop in valuations for female founders.

Late-stage and growth companies have seen substantial increases in valuations, with women-founded companies achieving some of the strongest positions in recent years. Among venture-growth companies, valuations increased from EUR 19.9 million in 2023 to EUR 28.9 million in 2024.

Women represent only 15% of the decision-makers in venture capital companies with a net worth of more than EUR 50 million and less in smaller companies. The number of active female angel investors has decreased by 40 per cent, contributing to a slowdown in female-backed deals on both sides of the table.

Women-founded companies experienced a significant increase in exits in 2024, with the number of transactions and cumulative value increasing by double-digits year-on-year.

Female founders secured a larger portion of the overall business during the year, with the value and number of exits increasing by 2.7% and 3.8% respectively.

ALL RIGHTS RESERVED ©